Billionaire Charlie Munger is an experienced investor. He made a fortune before becoming Warren Buffett’s right-hand man at Berkshire Hathaway.

According to a press release from Berkshire Hathaway, Mr. Munger passed away on the morning of November 28, 2023. His family members announced that he passed away peacefully at a hospital in California. He is about to turn 100 years old on New Year’s Day.

In a statement, Chairman Warren Buffett shared: “Berkshire Hathaway could not be where it is today without the inspiration, wisdom and cooperation of Mr. Charlie Munger.”

Besides being Vice Chairman of Berkshire Hathaway, billionaire Charlie Munger is a real estate lawyer, Chairman of Daily Journal Corp., a member of the Costco board of directors, a philanthropist and an architect.

As of early 2023, his assets are estimated at 2.3 billion USD, a number worthy of respect from many people. Charlie Munger is a towering figure in the financial world, the embodiment of wisdom in investing and in life. And like the hero he admired, Benjamin Franklin, Munger’s insight never lacked humor.

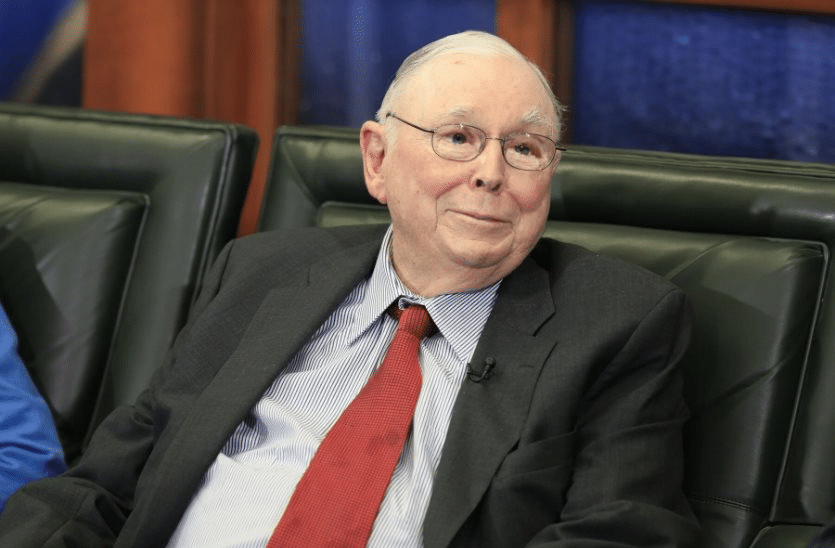

Investment genius Charlie Munger passed away at the age of 99: Warren Buffett’s right-hand man and confidant – Photo 1.

A person with a kind heart

Mr. Charles Thomas Munger was born in Omaha on January 1, 1924. His father was a lawyer and his mother came from a wealthy family. Like Warren Buffett, Munger worked at Mr. Buffett’s grocery store when he was young. But it was not until many years later that the two became partners.

At age 17, Munger left Omaha for the University of Michigan. Two years later, in 1943, he joined the US Air Force. The Army sent him to the California Institute of Technology in Pasadena to study meteorology. In California, he fell in love with Nancy Huggins and got married in 1945. Although he had not completed college, Munger graduated from Harvard Law School in 1948. After that, the two moved to California to live.

Here, Charlie Munger opened the law firm Munger, Tolles & Olson in 1962 and focused on managing investments at hedge fund Wheeler, Munger & Co.

Investment genius Charlie Munger passed away at the age of 99: Warren Buffett’s right-hand man and confidant – Photo 2.

In an interview with Michigan Ross School of Business in 2017, Mr. Munger shared that family comes first. Being rich is not as important as maintaining morality and being able to help others when they are in trouble.

At that time, Munger had 5 real estate projects. He worked both jobs in parallel for several years. And in just that time he had 3-4 million USD.

In 1975, he closed his hedge fund. Three years later, he became vice chairman of Berkshire Hathaway.

Our thoughts are unbelievably in sync

In 1959, at age 35, Munger returned to Omaha to close his law firm. That’s when he was introduced to Warren Buffett, then 29 years old, by an investment client. The two began to get close and kept in touch despite living half a continent apart.

“We thought in an uncanny way,” Buffett recalled in an interview with the Omaha World-Herald in 1977. He is the smartest and classiest guy I have ever met.”

In 2018, Warren Buffett shared with CNBC: “We have never argued in the entire time we have known each other, which has been nearly 60 years now.” Buffett further shared that his close friend gave him the greatest gift, which was helping him become a better person through advice.

Investment genius Charlie Munger passed away at the age of 99: Warren Buffett’s right-hand man and confidant – Photo 3.

Both legendary investors are people who focus on core values. Mr. Munger once said: “All smart investments are value investments. You will get back more than you spent. You have to value the business to value the stock.”

During the coronavirus outbreak in early 2020, when Berkshire suffered a whopping $50 billion loss in the first quarter, Munger and Buffett were more cautious than during the Great Recession.

Under the stewardship of Buffett and Munger, Berkshire posted an average annual gain of 20% from 1965 to 2022, nearly twice the pace of the S&P 500 Index. The combined decades of returns make the pair the billionaire and is loved and admired by many investors.

Munger has donated hundreds of millions of dollars to educational institutions, including the University of Michigan, Stanford University and Harvard Law School. Munger’s condition was that the school needed to accept his building designs.

In 2019, Mr. Munger shared with CNBC: “Always be happy…because that is the wise thing to do. Is that very difficult? Can you be happy when completely immersed in hatred and resentment? Of course not, so why should you?”