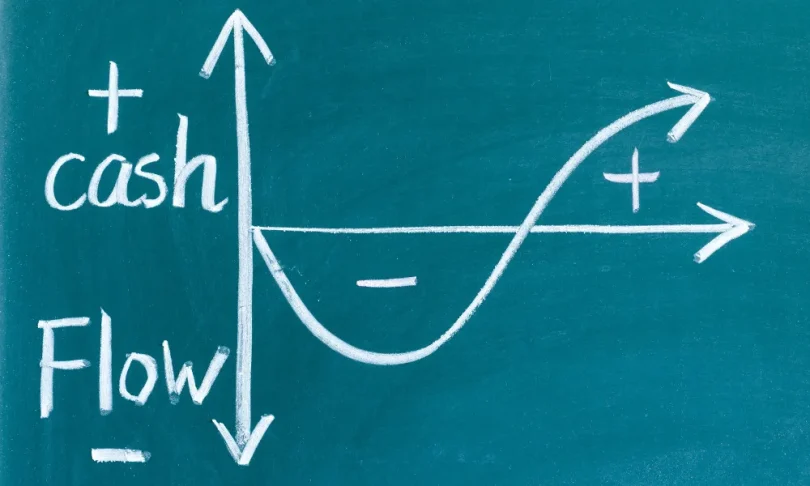

Every business—even the ones that look flush on Instagram—hits the awkward stage where bills fall due before incoming cash shows up. When that gap lingers, payroll, rent, and supplier invoices can threaten momentum or even survival.

The good news is that tight cash does not always signal a bad business model; many profitable companies stumble simply because money moves slower than obligations. With disciplined planning and creative tools, owners can keep operations humming until the next deposit lands.

Contents

Cash Flow Forecasting Is Non-Negotiable

Start by mapping your money’s rhythm. Pull last year’s bank statements and plot every inflow and outflow on a simple spreadsheet. Then project the next 13 weeks, line by line, adjusting for seasonality and known one-off events such as tax installments.

Seeing the highs and lows in advance lets you move expenses, delay discretionary purchases, or schedule collections calls at strategic moments. More importantly, regular forecasting makes cash flow management an active habit rather than a panicked reaction when balances dip.

Accelerate Receivables Without Alienating Customers

Sales mean nothing if invoices linger unpaid. Tighten your credit terms by shortening payment windows or introducing small prompt-pay discounts that preserve goodwill while nudging clients to act. Set automated reminders before and after due dates, and empower your accounting team to follow up the moment a deadline hits.

For larger accounts, consider breaking big invoices into milestone payments tied to clear deliverables, reducing exposure while keeping projects on track. Collecting faster costs little yet directly widens the gap between cash in and cash out.

Align Expenses With Realistic Revenue Cycles

In periods of thin liquidity, the easiest money to find is the cash you never spend. Scrutinize every subscription, vendor contract, and discretionary outlay against the forecast you just built. Negotiate extended payment terms that match your average collection cycle, or ask suppliers for temporary payment holidays in exchange for longer commitments once conditions normalize.

Consider switching variable costs, such as software licenses or part-time labor, to usage-based pricing so expense lines flex with income. Consistency in matching outgo with inflow keeps you stable during inevitable dips.

Tap Flexible Financing to Bridge Short Gaps

Even the most diligent planners sometimes face timing mismatches too large for internal tweaks alone. Short-term working-capital solutions—like a revolving line of credit, merchant cash advance, or selective invoice factoring—can supply oxygen without locking you into long debt tails.

Compare fees, speed, and covenants carefully, and borrow only what the forecast shows you can repay quickly. Savvy entrepreneurs increasingly sell individual invoices to platforms such as Factoring.io, accessing cash within days while still retaining control of customer relationships.

Conclusion

Cash shortages rarely announce themselves politely, but armed with a live forecast, faster collections, disciplined spending, and judicious outside funding, you can meet obligations without derailing growth plans.

Treat cash flow management as a daily operating metric, not an afterthought, and your business will remain resilient when external shocks arrive. Strong liquidity habits today ensure that tomorrow’s opportunities find you prepared, confident, and ready to reinvest in a competitive, cash-hungry marketplace.